CALL: (714) 210-5323

As reverse mortgage professionals, the facts about our industry matter to us. It is also important to us that reverse mortgage borrowers and potential reverse mortgage borrowers have those facts. We have included some of the basic facts about reverse mortgages here, but please feel free to contact us with any additional questions that you may have.

To become eligible for a reverse mortgage, you must be at least 62 years old and own your home. You must have equity in the house to pay off any outstanding balances, and your home must be occupied as your principal residence. All applicants are subject to a financial assessment to determine their financial capacity and willingness to pay obligations as part of the qualification process.

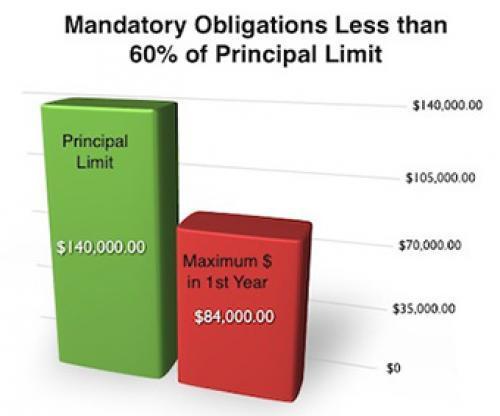

The amount of money that a lender will loan depends on how old you are at the time of closing, how much your house is worth, the total amount of liens, and interest rates. The payoff of your existing mortgage and mandatory obligations along with the payment option chosen will affect the amount of money you will receive. HUD limits borrowers to using 60% of the available money (after closing costs & fees) in the first year. The remaining funds are accessible beginning year two. This maximum disbursement limit set by HUD allows for the GREATER of:

There are several different options to choose from. You can take the money in a lump sum (up to HUD’s first-year maximum withdrawal)*, set up a line of credit, monthly payment, or a combination of all three. In the first year, the Line of Credit or monthly Tenure Payments or monthly payments cannot exceed 60% of the Principal Limit. After the first year, the available Line of Credit or Tenure/Monthly payments will be increased when applicable.

* Fixed interest rate reverse mortgages only allow for the Single Disbursement Lump Sum payment plan.

The fees and cost of a reverse mortgage are based on a number of items. For example, an origination fee is paid to the broker/lender, a MIP (mortgage insurance premium) is paid to FHA on the Home Equity Conversion Mortgage (HECM), an appraisal fee, a flood certification fee, a document preparation fee, title, settlement, and escrow fees. All costs are clearly shown on the Good Faith Estimate (GFE). Monthly servicing fees could apply.

FHA requires a Mortgage Insurance Premium (MIP) to be collected at closing and during the life of the loan. These premiums are charged to the borrower's loan balance. The upfront Mortgage Insurance Premium (MIP) is calculated using your home's appraised value or a maximum of $1,089,300 (the 2022 national lending limit cap) and is charged at closing. The ongoing FHA insurance premiums are calculated using each month's outstanding loan balance.

Yes. Counseling is required with an independent third-party HUD-approved counselor to protect borrowers from receiving incorrect information about reverse mortgages. The lender must be in receipt of the counseling certificate before they can close the loan. To locate a reverse mortgage counselor near you, contact your Mortgage Loan Originator or your local HUD office.

While the proceeds you receive from a reverse mortgage are typically not subject to individual income taxation, you will need to consult your tax advisor.

A reverse mortgage was created so borrowers don’t have to pay most fees during the course of the loan. Typical upfront costs are for the appraisal and HUD-approved reverse mortgage counseling (some agencies waive counseling fees at their discretion). However, there may be a monthly servicing fee associated with reverse mortgages (which will be financed and added to the loan balance). For more information on the service set-aside, please talk to your Mortgage Loan Originator.

AARP free information on reverse mortgages

Phone: 1-800-209-8085

The Consumer Financial Protection Bureau (CFPB) Consumer Lookup

http://www.nmlsconsumeraccess.org/

Housing Counseling Clearinghouse

Phone: 1-800-569-4287

The Eldercare Locator: Local Resources for Older Adults

http://www.eldercare.gov

Phone: 1-800-677-1116

Federal Trade Commission (FTC) to report possible fraud

http://www.ftc.gov

Phone: 1-877-FTC-HELP (1-877-382-4357)

National Council For Aging Care

http://www.aging.com/

Phone: 1-877-664-6140

This material is not provided by, nor was it approved by the Department of Housing & Urban Development (HUD) or by the Federal Housing Administration (FHA). It is not intended to be a substitute for legal, tax or financial advice. Consult with a qualified attorney, accountant or financial advisor for additional legal or tax advice.

* There are some circumstances that will cause the loan to mature and the balance to become due and payable. The borrower(s) must continue to pay for property taxes and insurance and maintain the property to meet HUD standards or risk default. Credit is subject to age, minimum income guidelines, credit history, and property qualifications. Program rates, fees, terms and conditions are not available in all states and subject to change.

Larry Paul

National Manager, C2 Reverse

NMLS #829110 | DRE #01183375

2552 White Road, Unit B

Irvine, CA 92614

Phone: (714) 210-5323

C2 Reverse, a division of C2 Financial Corp., NMLS #135622 | BRE #01821025